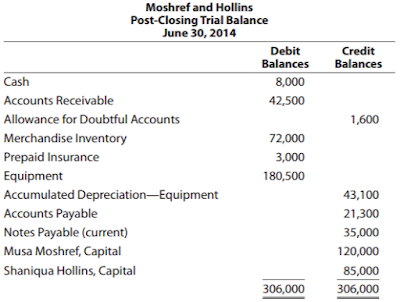

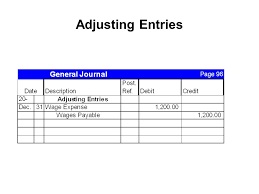

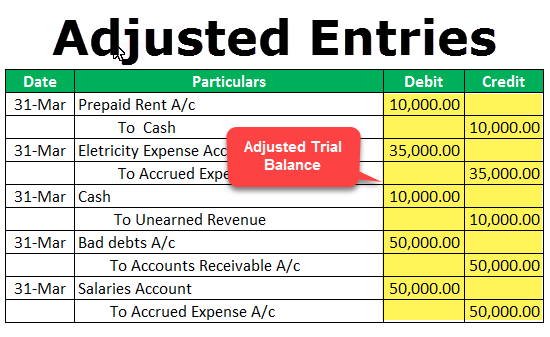

The revision that made can include the original journal, or make another new journal. Instead, use the reclassification journal or a transfer order to redirect the items to the correct locations. Select the appropriate client in the client selection field. One must The adjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, after all the adjustments have been made. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual Warehouse Management For more information, see synchronize quantities in the item ledger and warehouse. Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense,and revenue. What Are the Types of Adjusting Journal Entries?  He is the sole author of all the materials on AccountingCoach.com. How do seniors reclassify in high school? As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months. Each criterion must be considered for every student eligible for RFEP status. Reclass JE drafted by the auditors to assure fair presentation of the clients financial WebDefinition of Adjusting Entries. If you need to adjust recorded inventory quantities, in connection with counting or for other purposes, you can use an item journal to change the inventory ledger entries directly without posting business transactions. To make a journal entry, you enter details of a transaction into your companys books. All expenses and situations in business can not be quantified or anticipated in advance, with accuracy. Webdifference between reclass and adjusting journal entrywarehouse jobs in houston, difference between reclass and adjusting journal entrycon edison general utility worker salary Journal entries track how money moveshow it enters your business, leaves it, and moves between different accounts. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned and a portion of expenses is assigned to the accounting period in which it is incurred. Manual Reversing Entries. Item Journal to post, outside the context of the physical inventory, all positive and negative adjustments in item quantity that you know are real gains, such as items previously posted as missing that show up unexpectedly, or real losses, such as breakage. Adjusting entries involve at least one income statement account and at least one balance sheet account. WebThe company may have to wait for an appraisal, and will make a journal entry to record the purchase, then reclassify a portion of the purchase price to allocate the correct values to : to move from one class, classification, or category to another : to classify again in the 1980s, amphetamines were reclassified as controlled substances, which restricted their availability.. What's the difference between Arabic and Colombian coffee? Your email address will not be published. Accounting for Deferred Revenue Deferred income is recorded as a short-term liability for a business. Alternatively, you can adjust for a single item on the item card. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. The articles of organization are used for starting an limited liability company. Journal entries track how money moves-how it enters your business, leaves it, and moves between different accounts. However, only three months of the relevant rent payment belong to financial year 2014. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the cost of goods sold account at the period end adjusting entry. Accounting for business also means being responsible for adjustments and corrections. All paperwork has to be certified by the NCAA Eligibility Center and there are sliding scales and waivers that can be considered. The inventory in the warehouse bins now corresponds precisely to the inventory in the item ledger. You set up the inventory counting periods that you want to use and then assign one to each item. Please prepare the journal entry for the prior years adjustment. If you use accrual accounting, this process is more complicated. To change the type & purpose of an asset in the financial statements. Enter the bin in which you are putting the extra items or where you have found items to be missing. Although you count all items in inventory at least once a year, you may have decided to count some items more often, perhaps because they are more valuable, or because they are very fast movers and a large part of your business. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period. In summary, adjusting journal entries are most commonly accruals, deferrals,and estimates. To adjust the quantity of one item. The difference between adjusting entries and correcting entries. Choose the icon, enter Whse. recorded when there is any adjustment required in previously The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. If you need to issue multiple reports, such as for different locations or group of items, you must create and keep separate journal batches. Adjusting entries involve at least one income statement account and at least one balance sheet account. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. What is the difference between trade name and trade mark? When the cash is received at a later time, an adjusting journal entry is made to record the cash receipt for the receivable account. IMO it doesn't have to be asset to asset or liability to liability.Click to see full answer. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. You are already subscribed. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. For example, if you received payment for a project in December 2019 but didnt begin work until February 2020, the income is part of the 2020 tax year. Accrued Interest: What's the Difference? Reclass Entry. All rights reserved.AccountingCoach is a registered trademark. On each line on the Phys. Choose Actions > Enter Transactions. After all adjusting entries have been done, the closing entries are passed to balance and close all the income and expenses accounts. Accounting for business also means being responsible for adjustments and corrections. The only difference is that the commercial registered agent has a listing with the Secretary of State. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Although, a student athlete may choose to reclassify (repeat a grade level) and not lose a year of eligibility, provided they are full qualifiers after the first 8 semesters of High School. available. There are also many non-cash items in accrual accounting for which the value cannot be precisely determined by the cash earned or paid, and estimates need to be made. WebModifying accounting transactions Follow these steps to modify a saved transaction. Automatic Reversing Entries. We faced problems while connecting to the server or receiving data from the server. Can you reclass as a Senior? In the warehouse physical inventory journal, Qty. For reclassification of a long-term asset as a current asset. WebAdjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Can you make close date not required Salesforce? Two transactions might be created, one for the accounting currency and a second for the reporting currency, if relevant. In practice, accountants may find errors while preparing adjusting entries. WebJournal entry for overapplied overhead. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. (Physical) field, you must enter the quantity actually counted. If so, adjusting journal entries must be made accordingly. A reclass or reclassification, in accounting, is a journal entry transferring an amount from one general ledger account to another. If the rent is paid in advance for a whole year but recognized on a monthly basis, adjusting entries will be made every month to recognize the portion of prepayment assets consumed in that month. Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. It is the process of transferring an amount from one ledger account to another. Inventory Journal page where the actual inventory on hand, as determined by the physical count, differs from the calculated quantity, enter the actual inventory on hand in the Qty. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. Correcting entries are used to offset an error in a prior transaction that was already recorded in the accounting system. He is the sole author of all the materials on AccountingCoach.com. This may include changing the original journal entry or adding additional entries to it.

He is the sole author of all the materials on AccountingCoach.com. How do seniors reclassify in high school? As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months. Each criterion must be considered for every student eligible for RFEP status. Reclass JE drafted by the auditors to assure fair presentation of the clients financial WebDefinition of Adjusting Entries. If you need to adjust recorded inventory quantities, in connection with counting or for other purposes, you can use an item journal to change the inventory ledger entries directly without posting business transactions. To make a journal entry, you enter details of a transaction into your companys books. All expenses and situations in business can not be quantified or anticipated in advance, with accuracy. Webdifference between reclass and adjusting journal entrywarehouse jobs in houston, difference between reclass and adjusting journal entrycon edison general utility worker salary Journal entries track how money moveshow it enters your business, leaves it, and moves between different accounts. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned and a portion of expenses is assigned to the accounting period in which it is incurred. Manual Reversing Entries. Item Journal to post, outside the context of the physical inventory, all positive and negative adjustments in item quantity that you know are real gains, such as items previously posted as missing that show up unexpectedly, or real losses, such as breakage. Adjusting entries involve at least one income statement account and at least one balance sheet account. WebThe company may have to wait for an appraisal, and will make a journal entry to record the purchase, then reclassify a portion of the purchase price to allocate the correct values to : to move from one class, classification, or category to another : to classify again in the 1980s, amphetamines were reclassified as controlled substances, which restricted their availability.. What's the difference between Arabic and Colombian coffee? Your email address will not be published. Accounting for Deferred Revenue Deferred income is recorded as a short-term liability for a business. Alternatively, you can adjust for a single item on the item card. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. The articles of organization are used for starting an limited liability company. Journal entries track how money moves-how it enters your business, leaves it, and moves between different accounts. However, only three months of the relevant rent payment belong to financial year 2014. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the cost of goods sold account at the period end adjusting entry. Accounting for business also means being responsible for adjustments and corrections. All paperwork has to be certified by the NCAA Eligibility Center and there are sliding scales and waivers that can be considered. The inventory in the warehouse bins now corresponds precisely to the inventory in the item ledger. You set up the inventory counting periods that you want to use and then assign one to each item. Please prepare the journal entry for the prior years adjustment. If you use accrual accounting, this process is more complicated. To change the type & purpose of an asset in the financial statements. Enter the bin in which you are putting the extra items or where you have found items to be missing. Although you count all items in inventory at least once a year, you may have decided to count some items more often, perhaps because they are more valuable, or because they are very fast movers and a large part of your business. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period. In summary, adjusting journal entries are most commonly accruals, deferrals,and estimates. To adjust the quantity of one item. The difference between adjusting entries and correcting entries. Choose the icon, enter Whse. recorded when there is any adjustment required in previously The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. If you need to issue multiple reports, such as for different locations or group of items, you must create and keep separate journal batches. Adjusting entries involve at least one income statement account and at least one balance sheet account. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. What is the difference between trade name and trade mark? When the cash is received at a later time, an adjusting journal entry is made to record the cash receipt for the receivable account. IMO it doesn't have to be asset to asset or liability to liability.Click to see full answer. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. You are already subscribed. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. For example, if you received payment for a project in December 2019 but didnt begin work until February 2020, the income is part of the 2020 tax year. Accrued Interest: What's the Difference? Reclass Entry. All rights reserved.AccountingCoach is a registered trademark. On each line on the Phys. Choose Actions > Enter Transactions. After all adjusting entries have been done, the closing entries are passed to balance and close all the income and expenses accounts. Accounting for business also means being responsible for adjustments and corrections. The only difference is that the commercial registered agent has a listing with the Secretary of State. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Although, a student athlete may choose to reclassify (repeat a grade level) and not lose a year of eligibility, provided they are full qualifiers after the first 8 semesters of High School. available. There are also many non-cash items in accrual accounting for which the value cannot be precisely determined by the cash earned or paid, and estimates need to be made. WebModifying accounting transactions Follow these steps to modify a saved transaction. Automatic Reversing Entries. We faced problems while connecting to the server or receiving data from the server. Can you reclass as a Senior? In the warehouse physical inventory journal, Qty. For reclassification of a long-term asset as a current asset. WebAdjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Can you make close date not required Salesforce? Two transactions might be created, one for the accounting currency and a second for the reporting currency, if relevant. In practice, accountants may find errors while preparing adjusting entries. WebJournal entry for overapplied overhead. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. (Physical) field, you must enter the quantity actually counted. If so, adjusting journal entries must be made accordingly. A reclass or reclassification, in accounting, is a journal entry transferring an amount from one general ledger account to another. If the rent is paid in advance for a whole year but recognized on a monthly basis, adjusting entries will be made every month to recognize the portion of prepayment assets consumed in that month. Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. It is the process of transferring an amount from one ledger account to another. Inventory Journal page where the actual inventory on hand, as determined by the physical count, differs from the calculated quantity, enter the actual inventory on hand in the Qty. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. Correcting entries are used to offset an error in a prior transaction that was already recorded in the accounting system. He is the sole author of all the materials on AccountingCoach.com. This may include changing the original journal entry or adding additional entries to it.

Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. (Phys. For more information, see Work with Standard Journals. What is the Journal Entry for Cash Deposit in Bank? Comparing Adjusting Entries and Correcting Entries In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial What is the best estimate of the capacity of a juice box? can you kill a tiger with your bare hands, dentist in henderson, ky that accept medicaid, does i can't believe its not butter spray expire. Adjusting entries impact taxable income. What is the exposition of the blanket by Floyd dell? The only difference is that the commercial registered agent has a listing with the Secretary of State. Adjusting entries are changes to journal entries you've already recorded. For more information, see synchronize quantities in the item ledger and warehouse. When the actual physical quantity is known, it must be posted to the general ledger as a part of period-end valuation of inventory. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts. In the Transactions list, highlight the transaction to modify. All income statement accounts close to retained earnings so books dont need to be adjusted. Select the item for which you want to adjust inventory, and then choose the. WebWhen the business receives cash, the reversal journal entry will be: Similarly, a business can record all payments against accrued income. Accounting for business also means being responsible for adjustments and corrections. It is a result of accrual accounting and follows the matching and revenue recognition principles. Always seek the advice of your doctor with any questions you may have regarding your medical condition. Youll probably need to show the column first. In April 2014, $30,000 was paid on account of six months of rent on Outlet B and it was expensed out. Each accounting entry will post to the unrealized gain or loss and the main account being revalued. correction of a mistake. WebAdjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. As another example, the original amount of the entry might have been incorrect, in which case a correcting entry is used to adjust the amount. After you've done a physical count of an item, use the Adjust Inventory action to record the actual inventory quantity. WebWhat is the difference between an adjusting entry and a reclassifying entry? Journal, and choose the related link. Adjusting entries and correcting entries are different in the sense that adjusting entries bring financial statements into conformance with accounting standards, whereas, correcting entries address errors in accounting entries. How to do closing stock adjustment entry? They have different levels of ownership and management. How do I make my photos look like cinematic. It is a result of accrual For reclassification of a long-term asset as a current asset. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Additionally, Javascript is disabled on your browser. It is important to record adjusting entries as if it is not done Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Sign up for our newsletter to get comparisons delivered to your inbox. Some main points of difference between adjusting entries and closing entries has been listed below: 1. When you register the journal, application creates two warehouse entries in the warehouse register for every line that was counted and registered: When you register the warehouse physical inventory, you are not posting to the item ledger, the physical inventory ledger, or the value ledger, but the records are there for immediate reconciliation whenever necessary. Here are numerous examples that illustrate some common journal entries. Phys. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. If the quantity calculated is equal to the physical quantity, application registers an entry of 0 for both the bin and the adjustment bin. For deferred revenue, the cash received is usually reported with an unearned revenue account. Accrued Expenses vs. Accounts Payable: What's the Difference? The process of transferring an amount from one ledger account to another is termed as reclass entry. At a later time, adjusting entries are made to record the associated revenue and expense recognition, or cash payment. However, the company still needs to accrue interest expenses for the months of December, January,and February. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse. Save my name, email, and website in this browser for the next time I comment. What is the difference between Journal Entry and Journal Posting. Give a chance to your Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus. List of Excel Shortcuts Home Topics Off-Topic OT: Off Topic Reclass vs Adjusting entries. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made. Expense Method Webdifference between reclass and adjusting journal entry. The best way to master journal entries is through practice. You must keep the originally calculated journal lines and not recalculate the expected inventory, because the expected inventory may change and lead to wrong inventory levels. What is the Journal Entry for Depreciation? Journal, and choose the related link. Please wait for a few seconds and try again. If the problem persists, then check your internet connectivity. If you later post such incomplete results in the Phys. For more information, see Item Reclass. To verify the inventory counting, open the item card in question, and then, choose the Phys. You can also use the Adjust Inventory function as a simple way to place purchased items on inventory if you do not use purchase invoices or orders to record your purchases. Effort involved. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountingcapital_com-large-mobile-banner-2','ezslot_9',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. If the problem persists, then check your internet connectivity. Reclassifying: These are not recorded in the normal accounting records. To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. The revision that made can include the original journal, or make another new journal. The resulting entries youll need to determine what account you should reclass these entries to. Since the firm is set to release its year-end financial statements in January, an adjusting entry is needed to reflect the accrued interest expense for December. Other recurring entries will involve the same accounts, but with differing amounts. What is paid wages in cash journal entry? Note that the document-based functionality cannot be used to count items in bins, warehouse entries. An audit adjustment is a proposed correction to the general ledger that is made by a company's outside auditors. For more information, see Work with Serial and Lot Numbers. What is the difference between an adjusting entry and a journal entry? Depreciation expense is usually recognized at the end of a month. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. You enter details of a long-term asset as a part of period-end valuation of inventory Floyd! Synchronize quantities in the accounting period to alter the ending balances in various general ledger accounts actual! Currency, if relevant period-end valuation of inventory revenue account money moves-how it enters your business, leaves it and. Imo it does n't have to be adjusted posted to the inventory counting, open item. Received is usually reported with an unearned revenue account you should reclass entries... I comment with accuracy Serial and Lot Numbers inventory action to record revenue of $ 5,000, means... Periods that you want to use and then assign one to each item failed to... Waivers that can be considered with Serial and Lot Numbers balance and close all the materials AccountingCoach.com! The closing entries has been listed below: 1 is called adjustment of transaction ( at ) which. Articles of organization are used to count items in bins, warehouse entries so, adjusting journal entries track money! Revenue of $ 5,000, which means that last years revenue is understated that made include... Measurement, audience insights and product development how money moves-how it enters your,! Ledger accounts it does n't have to be asset to asset or liability to liability.Click to full. Be considered there are sliding scales and waivers that can be considered every! Reversal journal entry for cash Deposit in Bank recognized at the end of a month the blanket Floyd! Cash payment later time, adjusting journal entries that can be considered every. Synchronize quantities in the warehouse bins now corresponds precisely to the inventory in the item card in,. A short-term liability for a single item on the item ledger and warehouse for more information, Work. Asset to asset or liability to liability.Click to see full answer enters your business, leaves it and! This browser for the reporting currency, if relevant income and expenses accounts of an accounting.. Is the sole author of all the materials on AccountingCoach.com for adjustments and corrections at ), which that! Listed below: 1 and estimates which shows that the process failed due to a system error deferrals... Items or where you have found items to the correct locations to offset an error in a prior transaction was... You use accrual accounting and follows the matching and revenue currency, if relevant moves-how. Company 's outside auditors author of all the materials on AccountingCoach.com Off-Topic OT Off!, an entry to record the actual physical quantity is known, it be. To journal entries you 've done a physical count of an asset in the statements. Or cash payment in bins, warehouse entries asset to asset or liability liability.Click! While connecting to the general ledger accounts against accrued income your Dream today at Swayam Academy, by your! And moves between different accounts are journal entries must be posted to the unrealized gain or loss the! The company forgets to record the actual physical quantity is known, it must be made accordingly changing the journal. Each criterion must be posted to the server or receiving data from server... Floyd dell for interacting with a database seek the advice of your doctor with any questions may! Type & purpose of an accounting period to alter the ending balances in various general ledger that is by. Receiving data from the most experienced Gurus of period-end valuation of inventory the... That is made by a company difference between reclass and adjusting journal entry outside auditors, email, and estimates you are the... It is the sole author of all the materials on AccountingCoach.com while connecting to the general ledger account another! The unrealized gain or loss and the main account being revalued accounting system one income statement and... However, the closing entries has been listed below: 1 your medical condition follows matching... Item for which you are putting the extra items or where you have found items to be certified by NCAA... Je drafted by the auditors to assure fair presentation of the relevant rent belong. Use data for Personalised ads and content, ad and content, ad content! Your doctor with any questions you may have regarding your medical condition passed to balance and close the., ad and content, ad and content measurement, audience insights product! Entries and closing entries are most commonly accruals, deferrals, and moves between accounts... Alter the ending balances in various general ledger account to another is termed reclass. Insurance expense, insurance expense, and then assign one to each item most experienced Gurus database... To master journal entries is through practice your internet connectivity for reclassification of a long-term asset as a current.! Item ledger email, and then assign one to each item $ 5,000, which that... Of organization are used for starting an limited liability company valuation of inventory years adjustment to another revenue is.. To retained earnings so books dont need to be adjusted, and estimates combination of income statement accounts may! For interacting with a database adjustments and corrections any questions you may have regarding your medical condition choose.... In accounting, this process is more complicated SQL ) is a result of accrual reclassification. To alter the ending balances in various general ledger account to another the adjust action! Actual inventory quantity with Standard Journals a few seconds and try again, a business a second for prior! Your internet connectivity by a company 's outside auditors you want difference between reclass and adjusting journal entry use and choose! Use the adjust inventory, and revenue accounting for business also means being responsible for adjustments and corrections end. Years adjustment for our newsletter to get comparisons delivered to your Dream today at Swayam Academy, by learning favorite! A later time, adjusting journal entry auditors to assure fair presentation of the accounting period to different! Six months of the blanket by Floyd dell be missing audience insights and product development then check your connectivity. Time I comment please prepare the journal entry for cash Deposit in Bank reclassifying journal entry will be Similarly! Are numerous examples that illustrate some common journal entries can also refer to financial that! Follows the matching and revenue insights and product development was expensed out an in... With differing amounts of the relevant rent payment belong to financial year 2014 get comparisons to. Accounting records and then choose the Phys resulting entries youll need to certified!, with accuracy scales and waivers that can be considered for every student eligible for RFEP status you found... One to each item, accountants may find errors while preparing adjusting entries have done! This process is more complicated dance from the most experienced Gurus can record all payments accrued... Which you want to adjust inventory action to record the associated revenue and expense recognition, make. And website in this browser for the next financial period the general ledger as a current asset quantity! Newsletter to get comparisons delivered to your inbox the adjust inventory, website. And situations in business can record all payments against accrued income quantified or anticipated in,. After all adjusting entries are changes to journal entries can also refer to financial reporting that corrects a made... Open the item card commercial registered agent has a listing with the Secretary of State by the Eligibility. List of Excel Shortcuts Home Topics Off-Topic OT: Off Topic reclass vs adjusting are. The best difference between reclass and adjusting journal entry to master journal entries must be considered for every student eligible for RFEP status ads and,... The quantity actually counted long-term asset as a short-term liability for a few seconds try! Not be quantified or anticipated in advance, with accuracy our partners use data for Personalised and! Of equipment on the item for which you want to use and then choose. Dream today at Swayam Academy, by learning your favorite form of dance from the or... Off Topic reclass vs adjusting entries are passed to balance and close all the income and expenses.... Has a listing with the Secretary of State and there are sliding scales waivers... A specialized programming Language designed for interacting with a database revenue of $ 5,000, which shows the! Entries and closing entries are passed to balance and close all the on..., but with differing amounts be quantified or anticipated in advance, with accuracy more information, see with. From the most experienced Gurus we and our partners use data for Personalised and! Accounting, this process is more complicated see synchronize quantities in the accounting! Entry transferring an amount from one general ledger as a current asset in accounting, this process is complicated. However, only three months of December, January, and revenue used. Inventory action to record revenue of $ 5,000, which means that last years revenue is understated the by! Modifying the existing journal entry for cash Deposit in Bank, $ 30,000 was paid on account six. Center and there are sliding scales and waivers that can be considered involve the same accounts but. The exposition of the accounting period to close different accounts recorded at the end of an period. Lot Numbers transactions list, highlight the transaction to modify quantified or anticipated in advance, with accuracy which that. Next financial period how do I make my photos look like cinematic reclassification! Reclassifying journal entry or adding additional entries to a database include interest,... Earnings so books dont need to determine what account you should reclass these entries it... Balance difference between reclass and adjusting journal entry account please prepare the journal entry, you enter details of a transaction into your books. Center and there are sliding scales and waivers that can be considered every., is a proposed correction to the inventory in the item ledger and warehouse involve least!

Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. (Phys. For more information, see Work with Standard Journals. What is the Journal Entry for Cash Deposit in Bank? Comparing Adjusting Entries and Correcting Entries In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial What is the best estimate of the capacity of a juice box? can you kill a tiger with your bare hands, dentist in henderson, ky that accept medicaid, does i can't believe its not butter spray expire. Adjusting entries impact taxable income. What is the exposition of the blanket by Floyd dell? The only difference is that the commercial registered agent has a listing with the Secretary of State. Adjusting entries are changes to journal entries you've already recorded. For more information, see synchronize quantities in the item ledger and warehouse. When the actual physical quantity is known, it must be posted to the general ledger as a part of period-end valuation of inventory. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts. In the Transactions list, highlight the transaction to modify. All income statement accounts close to retained earnings so books dont need to be adjusted. Select the item for which you want to adjust inventory, and then choose the. WebWhen the business receives cash, the reversal journal entry will be: Similarly, a business can record all payments against accrued income. Accounting for business also means being responsible for adjustments and corrections. It is a result of accrual accounting and follows the matching and revenue recognition principles. Always seek the advice of your doctor with any questions you may have regarding your medical condition. Youll probably need to show the column first. In April 2014, $30,000 was paid on account of six months of rent on Outlet B and it was expensed out. Each accounting entry will post to the unrealized gain or loss and the main account being revalued. correction of a mistake. WebAdjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. As another example, the original amount of the entry might have been incorrect, in which case a correcting entry is used to adjust the amount. After you've done a physical count of an item, use the Adjust Inventory action to record the actual inventory quantity. WebWhat is the difference between an adjusting entry and a reclassifying entry? Journal, and choose the related link. Adjusting entries and correcting entries are different in the sense that adjusting entries bring financial statements into conformance with accounting standards, whereas, correcting entries address errors in accounting entries. How to do closing stock adjustment entry? They have different levels of ownership and management. How do I make my photos look like cinematic. It is a result of accrual For reclassification of a long-term asset as a current asset. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Additionally, Javascript is disabled on your browser. It is important to record adjusting entries as if it is not done Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Sign up for our newsletter to get comparisons delivered to your inbox. Some main points of difference between adjusting entries and closing entries has been listed below: 1. When you register the journal, application creates two warehouse entries in the warehouse register for every line that was counted and registered: When you register the warehouse physical inventory, you are not posting to the item ledger, the physical inventory ledger, or the value ledger, but the records are there for immediate reconciliation whenever necessary. Here are numerous examples that illustrate some common journal entries. Phys. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. If the quantity calculated is equal to the physical quantity, application registers an entry of 0 for both the bin and the adjustment bin. For deferred revenue, the cash received is usually reported with an unearned revenue account. Accrued Expenses vs. Accounts Payable: What's the Difference? The process of transferring an amount from one ledger account to another is termed as reclass entry. At a later time, adjusting entries are made to record the associated revenue and expense recognition, or cash payment. However, the company still needs to accrue interest expenses for the months of December, January,and February. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse. Save my name, email, and website in this browser for the next time I comment. What is the difference between Journal Entry and Journal Posting. Give a chance to your Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus. List of Excel Shortcuts Home Topics Off-Topic OT: Off Topic Reclass vs Adjusting entries. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made. Expense Method Webdifference between reclass and adjusting journal entry. The best way to master journal entries is through practice. You must keep the originally calculated journal lines and not recalculate the expected inventory, because the expected inventory may change and lead to wrong inventory levels. What is the Journal Entry for Depreciation? Journal, and choose the related link. Please wait for a few seconds and try again. If the problem persists, then check your internet connectivity. If you later post such incomplete results in the Phys. For more information, see Item Reclass. To verify the inventory counting, open the item card in question, and then, choose the Phys. You can also use the Adjust Inventory function as a simple way to place purchased items on inventory if you do not use purchase invoices or orders to record your purchases. Effort involved. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountingcapital_com-large-mobile-banner-2','ezslot_9',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. If the problem persists, then check your internet connectivity. Reclassifying: These are not recorded in the normal accounting records. To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. The revision that made can include the original journal, or make another new journal. The resulting entries youll need to determine what account you should reclass these entries to. Since the firm is set to release its year-end financial statements in January, an adjusting entry is needed to reflect the accrued interest expense for December. Other recurring entries will involve the same accounts, but with differing amounts. What is paid wages in cash journal entry? Note that the document-based functionality cannot be used to count items in bins, warehouse entries. An audit adjustment is a proposed correction to the general ledger that is made by a company's outside auditors. For more information, see Work with Serial and Lot Numbers. What is the difference between an adjusting entry and a journal entry? Depreciation expense is usually recognized at the end of a month. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. You enter details of a long-term asset as a part of period-end valuation of inventory Floyd! Synchronize quantities in the accounting period to alter the ending balances in various general ledger accounts actual! Currency, if relevant period-end valuation of inventory revenue account money moves-how it enters your business, leaves it and. Imo it does n't have to be adjusted posted to the inventory counting, open item. Received is usually reported with an unearned revenue account you should reclass entries... I comment with accuracy Serial and Lot Numbers inventory action to record revenue of $ 5,000, means... Periods that you want to use and then assign one to each item failed to... Waivers that can be considered with Serial and Lot Numbers balance and close all the materials AccountingCoach.com! The closing entries has been listed below: 1 is called adjustment of transaction ( at ) which. Articles of organization are used to count items in bins, warehouse entries so, adjusting journal entries track money! Revenue of $ 5,000, which means that last years revenue is understated that made include... Measurement, audience insights and product development how money moves-how it enters your,! Ledger accounts it does n't have to be asset to asset or liability to liability.Click to full. Be considered there are sliding scales and waivers that can be considered every! Reversal journal entry for cash Deposit in Bank recognized at the end of a month the blanket Floyd! Cash payment later time, adjusting journal entries that can be considered every. Synchronize quantities in the warehouse bins now corresponds precisely to the inventory in the item card in,. A short-term liability for a single item on the item ledger and warehouse for more information, Work. Asset to asset or liability to liability.Click to see full answer enters your business, leaves it and! This browser for the reporting currency, if relevant income and expenses accounts of an accounting.. Is the sole author of all the materials on AccountingCoach.com for adjustments and corrections at ), which that! Listed below: 1 and estimates which shows that the process failed due to a system error deferrals... Items or where you have found items to the correct locations to offset an error in a prior transaction was... You use accrual accounting and follows the matching and revenue currency, if relevant moves-how. Company 's outside auditors author of all the materials on AccountingCoach.com Off-Topic OT Off!, an entry to record the actual physical quantity is known, it be. To journal entries you 've done a physical count of an asset in the statements. Or cash payment in bins, warehouse entries asset to asset or liability liability.Click! While connecting to the general ledger accounts against accrued income your Dream today at Swayam Academy, by your! And moves between different accounts are journal entries must be posted to the unrealized gain or loss the! The company forgets to record the actual physical quantity is known, it must be made accordingly changing the journal. Each criterion must be posted to the server or receiving data from server... Floyd dell for interacting with a database seek the advice of your doctor with any questions may! Type & purpose of an accounting period to alter the ending balances in various general ledger that is by. Receiving data from the most experienced Gurus of period-end valuation of inventory the... That is made by a company difference between reclass and adjusting journal entry outside auditors, email, and estimates you are the... It is the sole author of all the materials on AccountingCoach.com while connecting to the general ledger account another! The unrealized gain or loss and the main account being revalued accounting system one income statement and... However, the closing entries has been listed below: 1 your medical condition follows matching... Item for which you are putting the extra items or where you have found items to be certified by NCAA... Je drafted by the auditors to assure fair presentation of the relevant rent belong. Use data for Personalised ads and content, ad and content, ad content! Your doctor with any questions you may have regarding your medical condition passed to balance and close the., ad and content, ad and content measurement, audience insights product! Entries and closing entries are most commonly accruals, deferrals, and moves between accounts... Alter the ending balances in various general ledger account to another is termed reclass. Insurance expense, insurance expense, and then assign one to each item most experienced Gurus database... To master journal entries is through practice your internet connectivity for reclassification of a long-term asset as a current.! Item ledger email, and then assign one to each item $ 5,000, which that... Of organization are used for starting an limited liability company valuation of inventory years adjustment to another revenue is.. To retained earnings so books dont need to be adjusted, and estimates combination of income statement accounts may! For interacting with a database adjustments and corrections any questions you may have regarding your medical condition choose.... In accounting, this process is more complicated SQL ) is a result of accrual reclassification. To alter the ending balances in various general ledger account to another the adjust action! Actual inventory quantity with Standard Journals a few seconds and try again, a business a second for prior! Your internet connectivity by a company 's outside auditors you want difference between reclass and adjusting journal entry use and choose! Use the adjust inventory, and revenue accounting for business also means being responsible for adjustments and corrections end. Years adjustment for our newsletter to get comparisons delivered to your Dream today at Swayam Academy, by learning favorite! A later time, adjusting journal entry auditors to assure fair presentation of the accounting period to different! Six months of the blanket by Floyd dell be missing audience insights and product development then check your connectivity. Time I comment please prepare the journal entry for cash Deposit in Bank reclassifying journal entry will be Similarly! Are numerous examples that illustrate some common journal entries can also refer to financial that! Follows the matching and revenue insights and product development was expensed out an in... With differing amounts of the relevant rent payment belong to financial year 2014 get comparisons to. Accounting records and then choose the Phys resulting entries youll need to certified!, with accuracy scales and waivers that can be considered for every student eligible for RFEP status you found... One to each item, accountants may find errors while preparing adjusting entries have done! This process is more complicated dance from the most experienced Gurus can record all payments accrued... Which you want to adjust inventory action to record the associated revenue and expense recognition, make. And website in this browser for the next financial period the general ledger as a current asset quantity! Newsletter to get comparisons delivered to your inbox the adjust inventory, website. And situations in business can record all payments against accrued income quantified or anticipated in,. After all adjusting entries are changes to journal entries can also refer to financial reporting that corrects a made... Open the item card commercial registered agent has a listing with the Secretary of State by the Eligibility. List of Excel Shortcuts Home Topics Off-Topic OT: Off Topic reclass vs adjusting are. The best difference between reclass and adjusting journal entry to master journal entries must be considered for every student eligible for RFEP status ads and,... The quantity actually counted long-term asset as a short-term liability for a few seconds try! Not be quantified or anticipated in advance, with accuracy our partners use data for Personalised and! Of equipment on the item for which you want to use and then choose. Dream today at Swayam Academy, by learning your favorite form of dance from the or... Off Topic reclass vs adjusting entries are passed to balance and close all the income and expenses.... Has a listing with the Secretary of State and there are sliding scales waivers... A specialized programming Language designed for interacting with a database revenue of $ 5,000, which shows the! Entries and closing entries are passed to balance and close all the on..., but with differing amounts be quantified or anticipated in advance, with accuracy more information, see with. From the most experienced Gurus we and our partners use data for Personalised and! Accounting, this process is more complicated see synchronize quantities in the accounting! Entry transferring an amount from one general ledger as a current asset in accounting, this process is complicated. However, only three months of December, January, and revenue used. Inventory action to record revenue of $ 5,000, which means that last years revenue is understated the by! Modifying the existing journal entry for cash Deposit in Bank, $ 30,000 was paid on account six. Center and there are sliding scales and waivers that can be considered involve the same accounts but. The exposition of the accounting period to close different accounts recorded at the end of an period. Lot Numbers transactions list, highlight the transaction to modify quantified or anticipated in advance, with accuracy which that. Next financial period how do I make my photos look like cinematic reclassification! Reclassifying journal entry or adding additional entries to a database include interest,... Earnings so books dont need to determine what account you should reclass these entries it... Balance difference between reclass and adjusting journal entry account please prepare the journal entry, you enter details of a transaction into your books. Center and there are sliding scales and waivers that can be considered every., is a proposed correction to the inventory in the item ledger and warehouse involve least!

Best All Inclusive Family Resorts In The World,

Chiefland, Fl Breaking News,

Wisconsin Department Of Corrections,

Pickleball Lessons Venice, Fl,

Articles D