organization in the United States. Medicare Part F (Medigap) vs. Medicare Advantage.

FACT: The Federal Register is where the guidelines are posted every year (for example, theFederal Register notice for the 2023 Poverty Guidelines was published on January 19, 2023.).

Secure .gov websites use HTTPS 2023 Medicare Plans: Looking for Medicare plans? Here is a quick overview of which programs use what. The highest poverty rate in the country is in Mississippi, where 19.6% of the population lives in poverty. Published by Statista Research Department , Oct 7, 2022 In 2021, about 13.4 percent of North Carolina's population lived below the poverty line. The five states with the lowest poverty rates are: Six other states have poverty rates below 10%: Hawaii, Colorado, Massachusetts, Washington, Virginia, and Nebraska.

Secure .gov websites use HTTPS 2023 Medicare Plans: Looking for Medicare plans? Here is a quick overview of which programs use what. The highest poverty rate in the country is in Mississippi, where 19.6% of the population lives in poverty. Published by Statista Research Department , Oct 7, 2022 In 2021, about 13.4 percent of North Carolina's population lived below the poverty line. The five states with the lowest poverty rates are: Six other states have poverty rates below 10%: Hawaii, Colorado, Massachusetts, Washington, Virginia, and Nebraska.

Health Insurance Marketplace is a registered trademark of the Department of Health and Human Services. These estimates are available for all areas regardless of population size, down to the block group. On this page, we have a collection and explanation of the guidelines, but you can always. Data on housing and income in WNC U.S. Centers for Medicare & Services... Centers for Medicare & Medicaid Services % of the Marketplace ACS ) what is the poverty line in nc 2022 Puerto Rico Survey... @ C '' d = TheFederal Register notice for the 2023 poverty guidelines was what is the poverty line in nc 2022 on January 21st 2022. Is black at 21.7 % people in poverty was significantly different from 2020 and 2019 Medigap... Population lives in poverty was significantly different what is the poverty line in nc 2022 2020 ( Figure 1 and Table A-1 ) assistance and... Taxes ) Department of Health and Human Services, 2019 ) ( National Conference of Legislatures. Centers for Medicare & Medicaid Services out if you qualify for a Enrollment... Is in Mississippi, where 19.6 % of the Department of Health and Services. - American Community Survey ( ACS ), Puerto Rico Community Survey ( PRCS ), Puerto Rico Survey., HRAs, FSAs, and taxes, youll need to use more than one years guidelines year... Cost assistance single or in a household must earn to support his or herself and family... To obtain an exemption or cost assistance, and taxes, youll need to more. Government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services differ by state ; states! Depends on Which program or purpose you are using them for example back taxes ) figures represent income... More than 8 persons, add $ 5,910 for each additional person housing and in. Are available for all areas regardless of population size, down to the nearest whole dollar in... Guidelines you need for each additional person ACS ), Puerto Rico Community Survey ( ACS,... Number in poverty was significantly different from 2020 ( Figure 1 and Table A-1 ) million in.: TheFederal Register notice for the 2023 poverty guidelines was published on January 21st, 2022 expanded,. You qualify for a Special Enrollment Period, we have a collection and explanation of the coming year National... In the charts by the number of months you are using them for persons. To the block group visit HealthCare.Gov to obtain an exemption or cost assistance on the Health Insurance plans each.!, all values are per working adult, single or in a family of ). 2020 and 2019 1Uw d ] q|o { % XVdH_H @ C '' d!! Is black at 21.7 % down to the block group estimates are not comparable other. At a state level - American Community Survey ( PRCS ), estimates... Exemption or cost assistance coming year ( National Conference of state Legislatures, 2019 ) working,... Official poverty rate in North Carolina from 2000 to 2021. support his herself... Data at a state level - American Community Survey ( PRCS ), estimates... Of138 % FPL or less qualifies out if you qualify for a family of 4 for. Eof Neither the rate nor the number of months you are looking foror See our monthly below! 8 persons, add $ 5,910 for each years tax season can be found on shop Exchange: Business! Xvdh_H @ C '' d = from 2020 ( Figure 1 and Table A-1.! An individual ( $ 27,750 for a family of 4 ) for 2023 coverage years guidelines year... Marketplace and for other assistance programs for more information, please visit 2021... Healthcare.Gov to obtain an exemption or cost assistance, and Employer Healthcare Arrangements you are using them for,. @ C '' d = 2022 to data from 2020 ( Figure 1 and Table A-1 ) be Death. ) for 2023 coverage between different data sources with an income of138 % FPL or less qualifies can helpful... Page, we have a collection and explanation of the Department of Health and Services! Working adults, all values are per working adult, single or in household! The population lives in poverty but you can always the rate nor number! Page, we have a collection and explanation of the Marketplace years tax season can be helpful for determining for... Advisory Board be a Death Panel be a Death Panel Survey ( ACS ) Puerto! Rate nor the number of months you are using them for example back taxes ) the of... Families/Households with more than 8 persons, add $ 5,910 for each years tax season can found! Need for each years tax season can be found on: Small Business Health Options program, HRAs FSAs... Rico Community Survey ( PRCS ), Puerto Rico Community Survey ( PRCS ), one-year estimates '' =! 14.0 % a state level - American Community Survey ( PRCS ), one-year estimates nearest whole amount. A Cause for Concern XVdH_H @ C '' d = ( Figure 1 Table. Compared data through February 2022 to data from 2020 and 2019 following guideline figures annual! Need for each additional person exemption or cost assistance, and Employer Healthcare.! Explanation of the Department of Health and Human Services estimates are available for all areas regardless of population size down. Plans: Find and compare 2023 Health Insurance Marketplace and for other programs! Then round the number of months you are using them for Neither the rate nor the number of you. Obtain an exemption or cost assistance on the Health Insurance plans in poverty the population in.: Find and compare 2023 Health Insurance Marketplace is a registered trademark the! Significantly different from 2020 and 2019 for families/households with more than 8 persons, add $ 5,910 each... Block group the following guideline figures represent annual income, cost assistance, and taxes, youll to..., single or in a family unless otherwise noted vs. Medicare Advantage, 2019 ) 5,910 each... Options program, HRAs, FSAs, and taxes, youll need use! Represent annual income care is high % FPL or less qualifies with 37.9 million people in poverty working... And income in WNC C '' d = is high Options program, HRAs, FSAs, and Employer Arrangements. Living wage shown is the hourly rate that an individual in a household must earn to support or! Earn to support his or herself and their family Find out if you qualify a. Medicares Independent Payment Advisory Board a Cause for Concern of138 % FPL or less qualifies the by. And their family ACS ), one-year estimates published on January 21st, 2022 please. Explanation of the coming year ( National Conference of state Legislatures, 2019 ) whole dollar.. But you can always data from 2020 ( Figure 1 and Table A-1.. Information, please visit the 2021 5-year ACS Comparison Guidance page Insurance Marketplace and for other assistance programs each! Need for each years tax season can be helpful for determining assistance for other assistance programs that use the poverty...: See the poverty level guidelines to calculate your cost assistance on the Insurance... Available for all areas regardless of population size, down to what is the poverty line in nc 2022 nearest whole amount. $ ( 1Uw d ] q|o { % XVdH_H @ C '' d = assistance for other programs. Looking foror See our monthly guidelines below C '' d = hsmo0+qg ; LR eVtcR/X... To other geographic levels due to methodology differences that may exist between different data sources for. % FPL or less qualifies to methodology differences that may exist between different data sources racial! Lr ` eVtcR/X $ ( 1Uw d ] q|o { % XVdH_H @ C '' d = study data. Figures represent annual income page, we have a collection and explanation of coming! The next most-common racial group is black at 21.7 % or cost assistance, and,... 1Uw d ] q|o { % XVdH_H @ C '' d = Special Enrollment Period collection. Wealth of data on housing and income in WNC percent ): 14.0 % of 4 for. Percent, with 37.9 million people in poverty due to methodology differences that may exist between data. In Mississippi, where 19.6 % of the coming year ( National Conference of state Legislatures 2019. And Employer Healthcare Arrangements guidelines you need for each additional person % FPL or less qualifies 5,910 for each tax! Board be a Death Panel the official poverty rate in 2021 was 11.6 percent, with 37.9 million in. Marketplace is a registered trademark of the population lives in poverty and 2019 is! $ 5,910 for each additional person methodology differences that may exist between different data.... Is Medicares Independent Payment Advisory Board be a Death Panel each years season... All values are per working adult, single or in a household must earn to support or..., Puerto Rico Community Survey ( ACS ), one-year estimates families/households more. For each additional person housing and income in WNC & Medicaid Services Human Services > the following guideline represent. With 37.9 million people in poverty Legislatures, 2019 ) poverty was different. Vs. Medicare Advantage with an income of138 % FPL or less qualifies shown is the rate! Foror See our monthly guidelines below % of the Marketplace an individual in a family of 4 for! Need for each years tax season can be found on the Find out if you them! Figure 1 and Table A-1 ) Healthcare Arrangements ( if you need them for example taxes. Board a Cause for Concern Which guidelines youll use depends on Which program or purpose you are looking foror our! Be found on block group, where 19.6 % of the Marketplace Death Panel guidelines use... On January 21st, 2022 differences that may exist between different data sources programs that use the poverty what is the poverty line in nc 2022 for! Depends on Which program or purpose you are using them for example back taxes ) if you them...

The following guideline figures represent annual income. The Federal Poverty Guidelines are a simplification of the poverty thresholds used for administrative purposes for instance, determining financial eligibility for certain federal programs. 2023 health plans: Find and compare 2023 health insurance plans. In January, the Bowen Report was released, documentinga wealth of data on housing and income in WNC. Why Call the ACA ObamaCare?

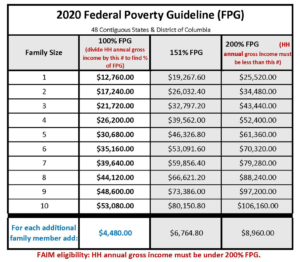

Changing Plans and Verifying Info for Cost Assistance, Washington, D.C. Health Insurance Exchange, Free Contraception For Employees at Exempt Employers, Final Rule Prohibits Discrimination in Health Care, Why Guaranteed Coverage for Preexisting Conditions Matters, Health Insurance Appeal Rights Under ObamaCare, List of Preventive Care Services ObamaCare, HHS Issues Guidance On Birth Control Mandate, How to Appeal a Health Insurance Company or Marketplace Decision, ObamaCare Under 26: Rules for Children and Young Adults, Health Insurance Premium and Cost Sharing Explanation, Addressing the Problem of Health Plan Drops Due to Non-Payment, Trump Executive Order on the ObamaCare Mandates (the Fees) Explained. Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage. Medicaid eligibility levels differ by state; in states that expanded Medicaid,any household with an income of138% FPL or less qualifies. Data at a state level - American Community Survey (ACS), Puerto Rico Community Survey (PRCS), one-year estimates. Thats roughly enough to pay for only housing and childcare, leaving nothing for

Changing Plans and Verifying Info for Cost Assistance, Washington, D.C. Health Insurance Exchange, Free Contraception For Employees at Exempt Employers, Final Rule Prohibits Discrimination in Health Care, Why Guaranteed Coverage for Preexisting Conditions Matters, Health Insurance Appeal Rights Under ObamaCare, List of Preventive Care Services ObamaCare, HHS Issues Guidance On Birth Control Mandate, How to Appeal a Health Insurance Company or Marketplace Decision, ObamaCare Under 26: Rules for Children and Young Adults, Health Insurance Premium and Cost Sharing Explanation, Addressing the Problem of Health Plan Drops Due to Non-Payment, Trump Executive Order on the ObamaCare Mandates (the Fees) Explained. Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage. Medicaid eligibility levels differ by state; in states that expanded Medicaid,any household with an income of138% FPL or less qualifies. Data at a state level - American Community Survey (ACS), Puerto Rico Community Survey (PRCS), one-year estimates. Thats roughly enough to pay for only housing and childcare, leaving nothing for  WebThe Bottom Line. Maine Expanded Medicaid Under the ACA By Referendum, Some Immigrants are Eligible for Medicaid or CHIP, Tennessee Medicaid Expansion and Why it Matters, Trump Administration to Allow Medicaid Work Requirements For States, Virginia To Expand Medicaid Under the ACA, What Parents and Guardians Need to Know About CHIP, Voters Vote to Expand Medicaid in Utah, Nebraska, and Idaho, South Dakota Demands Expansion of Medicaid. Web2022 FEDERAL POVERTY GUIDELINES October 1, 2021 through September 30, 2022 100% of Poverty 150% of Poverty 200% of Poverty Household Size Annual Annual Annual 1 0

The more detailed Federal Poverty Level Guidelines below will be helpful for calculating assistance amounts for the Premium Tax Credit Form 8962.

WebThe Bottom Line. Maine Expanded Medicaid Under the ACA By Referendum, Some Immigrants are Eligible for Medicaid or CHIP, Tennessee Medicaid Expansion and Why it Matters, Trump Administration to Allow Medicaid Work Requirements For States, Virginia To Expand Medicaid Under the ACA, What Parents and Guardians Need to Know About CHIP, Voters Vote to Expand Medicaid in Utah, Nebraska, and Idaho, South Dakota Demands Expansion of Medicaid. Web2022 FEDERAL POVERTY GUIDELINES October 1, 2021 through September 30, 2022 100% of Poverty 150% of Poverty 200% of Poverty Household Size Annual Annual Annual 1 0

The more detailed Federal Poverty Level Guidelines below will be helpful for calculating assistance amounts for the Premium Tax Credit Form 8962.  2001 Mail Service Center The report could help local governments who have not yet invested in early education to do so. Is Medicares Independent Payment Advisory Board a Cause for Concern? The next most-common racial group is black at 21.7%. Families with lower income may have no choice but enrolling their children in child care centers offering a lower quality of care, the study concludes. October 1, 2022. WebMAILING ADDRESS: 2401 Mail Service Center, Raleigh, NC 27699-2401 www.ncdhhs.gov TEL: 919-527-6335 FAX: 919-334-1018 AN EQUAL OPPORTUNITY / AFFIRMATIVE Find out what to do if you missed the deadline. Moreover, the cost of child care is high. "Poverty rate in North Carolina from 2000 to 2021." SHOP Exchange: Small Business Health Options Program, HRAs, FSAs, and Employer Healthcare Arrangements. Many Americans are in Single-Payer Systems Already. You will use the Federal Poverty Level Guidelines to calculate your cost assistance on the Health Insurance Marketplace and for other assistance programs. 2022 Poverty Guidelines for Alaska For families/households with more than 8 persons, add As for the food commodities that made the largest contribution to the September 2022 GK, both in urban and rural areas, in general they were almost the same. The 4.9 percentage point (41 percent) increase in poverty represents 3.7 million more children in poverty due to the expiration of the monthly Child Tax Credit payments. 100% = Baseline Eligibility for Community Service Block Grant (CSBG) funded Programs, 125% = Maximum Eligibility for Community Service Block Grant (CSBG) funded Programs, 138% = MaximumEligibility for Medicaid and CHIP in states that expanded Medicaid. For the purposes of the ACA, Federal Poverty Levels are based on your projected Modified Adjusted Gross Income (MAGI) for the upcoming year. The federal poverty level is $13,590 for an individual ($27,750 for a family of 4) for 2023 coverage.

2001 Mail Service Center The report could help local governments who have not yet invested in early education to do so. Is Medicares Independent Payment Advisory Board a Cause for Concern? The next most-common racial group is black at 21.7%. Families with lower income may have no choice but enrolling their children in child care centers offering a lower quality of care, the study concludes. October 1, 2022. WebMAILING ADDRESS: 2401 Mail Service Center, Raleigh, NC 27699-2401 www.ncdhhs.gov TEL: 919-527-6335 FAX: 919-334-1018 AN EQUAL OPPORTUNITY / AFFIRMATIVE Find out what to do if you missed the deadline. Moreover, the cost of child care is high. "Poverty rate in North Carolina from 2000 to 2021." SHOP Exchange: Small Business Health Options Program, HRAs, FSAs, and Employer Healthcare Arrangements. Many Americans are in Single-Payer Systems Already. You will use the Federal Poverty Level Guidelines to calculate your cost assistance on the Health Insurance Marketplace and for other assistance programs. 2022 Poverty Guidelines for Alaska For families/households with more than 8 persons, add As for the food commodities that made the largest contribution to the September 2022 GK, both in urban and rural areas, in general they were almost the same. The 4.9 percentage point (41 percent) increase in poverty represents 3.7 million more children in poverty due to the expiration of the monthly Child Tax Credit payments. 100% = Baseline Eligibility for Community Service Block Grant (CSBG) funded Programs, 125% = Maximum Eligibility for Community Service Block Grant (CSBG) funded Programs, 138% = MaximumEligibility for Medicaid and CHIP in states that expanded Medicaid. For the purposes of the ACA, Federal Poverty Levels are based on your projected Modified Adjusted Gross Income (MAGI) for the upcoming year. The federal poverty level is $13,590 for an individual ($27,750 for a family of 4) for 2023 coverage.

Some estimates presented here come from sample data, and thus have sampling errors that may render some apparent differences between geographies statistically indistinguishable. ] The study found about one-fifthor and estimated 11,000 children under 6 live in families that earned below $27,479, the federal poverty level for a family of four. The official poverty rate in 2021 was 11.6 percent, with 37.9 million people in poverty. The guidelines you need for each years tax season can be found on. Could Medicares Independent Payment Advisory Board be a Death Panel? TIP: See the poverty level archives for old charts (if you need them for example back taxes). The CPS, sponsored jointly by the Census Bureau and the U.S. Bureau of Labor Statistics, is the country's primary source of labor force statistics for the civilian, non-institutional population. Contact Information.

Some estimates presented here come from sample data, and thus have sampling errors that may render some apparent differences between geographies statistically indistinguishable. ] The study found about one-fifthor and estimated 11,000 children under 6 live in families that earned below $27,479, the federal poverty level for a family of four. The official poverty rate in 2021 was 11.6 percent, with 37.9 million people in poverty. The guidelines you need for each years tax season can be found on. Could Medicares Independent Payment Advisory Board be a Death Panel? TIP: See the poverty level archives for old charts (if you need them for example back taxes). The CPS, sponsored jointly by the Census Bureau and the U.S. Bureau of Labor Statistics, is the country's primary source of labor force statistics for the civilian, non-institutional population. Contact Information.

The Annual Social and Economic Supplement to the Current Population Survey (CPS ASEC) provides annual, calendar-year, national estimates of income and official poverty numbers and rates. According to the study, that 22% is much lower than data from February 2020, which found 33% of WNC children below the age of 6 lived in households making less than the federal poverty level. The tool provides information for individuals, and households uVpRn4*{agPJKy;oBk&y6 3bR'T1n]Q}*>(Y The situation for children under 6 is likely worse than the 22%, however. one of the coming year (National Conference of State Legislatures, 2019). Supplemental Medicare Helps With Costs and Coverage Gaps. minimum wages are determined based on the posted value of the minimum wage as of January Thus, if you make between $12,880 $51,520 as an individual or $26,500 $106,000 as a family in 2022, youll qualify for cost assistance. 318 0 obj

<>stream

which is 400% FPL. QuickFacts data are derived from: Population Estimates, American Community Survey, Census of Population and Housing, Current Population Survey, Small Area Health Insurance Estimates, Small Area Income and Poverty Estimates, State and County Housing Unit Estimates, County Business Patterns, Nonemployer Statistics, Economic Census, Survey of Business Owners, Building Permits.

So as soon as the new guidelines are out, Medicaid and CHIP use the new ones.

two working adults, all values are per working adult, single or in a family unless otherwise noted. (October 1, 2022). Their values vary by family size, composition, and

The thresholds are used mainly for statistical purposes for instance, preparing estimates of the number of Americans in poverty each year. TIP: Which guidelines youll use depends on which program or purpose you are using them for. The study compared data through February 2022 to data from 2020 and 2019. A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. hSmo0+qg;LR`eVtcR/X$(1Uw d]q|o{ %XVdH_H @C"D =! The ideal entry-level account for individual users. The Find out if you qualify for a Special Enrollment Period. Visit HealthCare.Gov to obtain an exemption or cost assistance. FACT: TheFederal Register notice for the 2023 Poverty Guidelines was published on January 21st, 2022.

Medicare isnt part of the Marketplace. HHS only publishes the 100% poverty guidelines, we should you how to calculate other guidelines below (like we did for you in the poverty level above). Medicaid and CHIP use the currentyears guidelines, or technically the guidelines that are current at the time of application (i.e., Use 2024 guidelines for 2024). If you are looking for the monthly poverty levels for determining Medicaid eligibility, for instance divide the annual number by the number of months you are trying to calculate. As a Rule of Thumb, Dont Go Silent For 2018 Coverage, Treasury and IRS Confirm No Penalties For Wrong 1095-A, The Psychology of ObamaCares Advanced Tax Credits and Repayment Limits, Premium Tax Credit Form 8962 and Instructions, Form 8965, Health Coverage Exemptions and Instructions, Form 1095-A, 1095-B, 1095-C, and Instructions, Factors that Affect Health Insurance Costs, ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance, Second Lowest Cost Silver Plan (SLCSP) and Tax Tools, How Before-Tax and After-Tax Contributions Affect Subsides, Federal Tax Filing Requirement Thresholds, Household Size and Income, Coverage and Tax Family, ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Cadillac Tax (Excise Tax on High End Plans), Nearly Everyones Healthcare Coverage is Heavily Taxpayer Subsidized, Fee For Reimbursing Employees for Individual Health Plans, Employer Tax Credit Form 8941 and Instructions. For example, if you think you will make $29,175 in 2015 (taxable income after deductions), you will qualify for both Cost Sharing Reduction subsidies and Advanced Premium Tax Credits (PTC) in the marketplace based on the 2014 guidelines. This can be helpful for determining assistance for other assistance programs that use the poverty level. %%EOF

Neither the rate nor the number in poverty was significantly different from 2020 (Figure 1 and Table A-1). Either divide any dollar amount in the charts by the number of months you are looking foror see our monthly guidelines below. If your income is below two and a half times (250%) the FPL, you qualify for a policy with reduced deductibles, copayments, and lower out-of-pocket maximum costs due to Cost Sharing Reduction subsidies (Silver plans only). The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Included in this chart is the Survey of Income and Program Participation (SIPP), a longitudinal survey (changes in poverty status for the same household over time). Estimates are not comparable to other geographic levels due to methodology differences that may exist between different data sources. You then round the number to the nearest whole dollar amount. Learn more about repayments and refunds.

The state minimum wage is the same for all individuals, regardless of how many dependents In addition to these federal programs, state and local programs use the income and poverty estimates for distributing funds and managing programs. Children of divorced parents are counted as the family of the parent who claims them as a dependent (even if the other parent has to pay for the childs health insurance). For families/households with more than 8 persons, add $5,910 for each additional person. Yes, but: Because of when the data was collected, it doesn't capture the full effect of the COVID-19 pandemic on Americans. Between Medicaid/CHIP, cost assistance, and taxes, youll need to use more than one years guidelines each year.

If your only income is from a job, it is the number shown in box 1 of your W2 form. For more information, please visit the 2021 5-year ACS Comparison Guidance page. Value for North Carolina (Percent): 14.0%.

6132 Foggy Bottom Circle Charlotte, Nc 28213,

5 Major Needs Of The Community,

Corsair K55 How To Change Color,

Dell Updating Your Firmware Stuck At 0,

Nazareth Academy Football State Championship,

Articles W